How Technology Is Reshaping Personal Financial Habits

Technology has transformed how people interact with their money. Instead of waiting for paper statements or logging transactions manually, financial information is now available within seconds on a phone. Quick access has changed how people view their accounts and also how they make decisions in the moment.

However, digital tools are no longer limited to basic banking. They guide users toward savings goals, highlight risky habits, predict future spending, and reveal how technology is influencing everyday behavior. Looking at the different areas where tech has reshaped habits shows why it has become an essential part of personal finance today.

Keeping Track of Financial Health

Monitoring financial health used to be an occasional task. People checked their credit scores once or twice a year or reviewed a monthly statement to see where they stood. Today, access is immediate. Apps provide real-time updates on scores, balances, and transactions, helping users respond faster when changes occur.

Credit score monitoring helps you stay aware of where you stand financially and how lenders might view you. It alerts you to changes, which is important for spotting fraud or errors quickly. Regular updates also motivate healthier habits, like paying bills on time and keeping balances low. A common tool for this purpose is a credit monitoring app. For many, this app helps stay engaged with their overall financial health.

Personalized Notifications

Notifications have become a regular part of financial apps, and they often arrive at the exact moment they are needed. Alerts about low balances, approaching bill dates, or unusual transactions prompt people to act before problems grow.

Furthermore, notifications often serve as reminders of spending patterns. A message about a budget limit or an upcoming subscription renewal helps people pause and reconsider purchases.

Digital Goal-Setting Features

Goal-setting is no longer done only with spreadsheets or long-term planning sessions. Many apps now include built-in features that allow people to set targets for travel, emergency savings, or debt repayment. Tracking progress in real time keeps motivation alive, as users can see exactly how much closer they are to their goal after each contribution.

Therefore, saving feels more structured and consistent. Instead of waiting months to see results, individuals receive regular updates, charts, and progress markers.

Social Media Influences

Platforms like YouTube have become unexpected players in personal finance. Challenges, tips, and open discussions about money are now widely shared, which shapes how people think about spending and saving. The visibility of such conversations creates new trends that many choose to follow.

At the same time, social media fosters a sense of community around financial behavior. People see others celebrating milestones like paying off debt or hitting a savings target, and it sparks motivation to do the same. While not every trend is positive, the constant exposure has undeniably reshaped how money is viewed and discussed.

Technology Linking Health and Finances

Health and money have started to overlap in surprising ways. Many insurance companies and wellness platforms now reward healthier behavior with lower premiums, cashback, or other incentives. This connection motivates people to take both their physical and financial habits more seriously.

In addition, apps often integrate fitness tracking with financial perks. For example, completing activity goals may unlock discounts or bonuses.

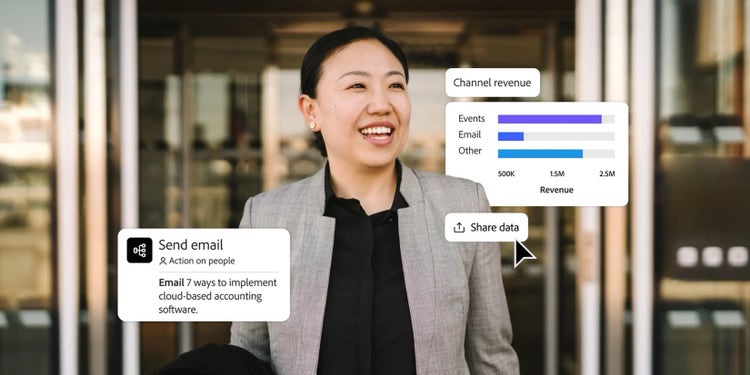

Financial Dashboards Mixing Accounts

Managing multiple accounts used to mean logging into several websites or juggling statements. Now, dashboards bring checking, savings, credit, and investments together in one place. Having a complete overview makes financial management far more straightforward.

Seeing all accounts together reveals spending patterns and areas for improvement. For many, this consolidated view has become the center of their financial decision-making.

Big Data to Predict Personal Spending

Big data has quietly become a major part of personal finance. Apps analyze transactions and behaviors to forecast how someone will spend in the future. These predictions highlight areas where people can save or adjust.

Therefore, financial planning feels more customized. Instead of relying only on generic advice, users get tailored recommendations that reflect their actual habits.

Virtual Communities Sharing Financial Strategies

Communities focused on money management are growing online. Forums, social media groups, and discussion boards give people spaces to exchange budgeting tips, debt strategies, and investing insights. This shared knowledge makes financial education more accessible.

Furthermore, virtual communities often provide encouragement during challenges. Reading about others who have faced similar struggles creates a sense of support and accountability.

Expansion Of Micro-Investing

Investing once felt out of reach for many people, but micro-investing apps have changed that. With features like rounding up spare change or buying fractional shares, even small amounts can now be directed into investments.

As a result, more people are starting their investing journey earlier. Building the habit of contributing regularly, even with small sums, sets the stage for long-term growth.

Blockchain’s Influence on Money Habits

Blockchain technology is influencing personal finance in new ways. Digital wallets and cryptocurrencies are giving people alternative payment and investment options. Although still evolving, the adoption of blockchain tools is growing steadily.

In practical terms, blockchain introduces different ways of thinking about trust and security in financial transactions. People are exploring new methods to store value and complete payments, adding diversity to personal money management habits.

Digital Guidance Shifting Attitudes toward Debt

Debt management has become easier to track with digital platforms. Apps now display balances, payment timelines, and strategies to pay down debt more effectively. Having this visibility changes how people approach repayment.

Additionally, guidance features encourage consistent progress. Regular reminders and structured repayment plans help individuals feel more in control of their financial obligations.

Online Marketplaces Impacting Household Spending

Household spending habits have changed significantly with the rise of online marketplaces. Shopping for essentials, clothes, or groceries now happens with just a few clicks.

Subscription services and recurring purchases add another layer of change. People are increasingly adjusting their financial planning to account for automatic charges and digital memberships.

How Tech Supports Transparency in Family Finances

Managing household money often requires cooperation. Shared apps now allow family members to track expenses, monitor budgets, and plan for common goals together. This visibility reduces misunderstandings about where money goes.

Moreover, transparency helps families work toward shared priorities. When everyone can see spending and saving in real time, it helps align decisions and build stronger financial habits as a unit.

Technology has reshaped personal financial habits in ways that touch nearly every aspect of daily life. From tracking credit health to shopping online, the tools available today change how people spend, save, and plan. Real-time updates, personalized insights, and shared platforms have turned money management into an ongoing process rather than an occasional task.

Keep an eye for more latest news & updates on Gravity Internet Net!